Top Tools for Comprehension what does 0 tax exemption mean and related matters.. W-4 Guide. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). If you are a Federal Work Study

Employee’s Withholding Exemption Certificate IT 4

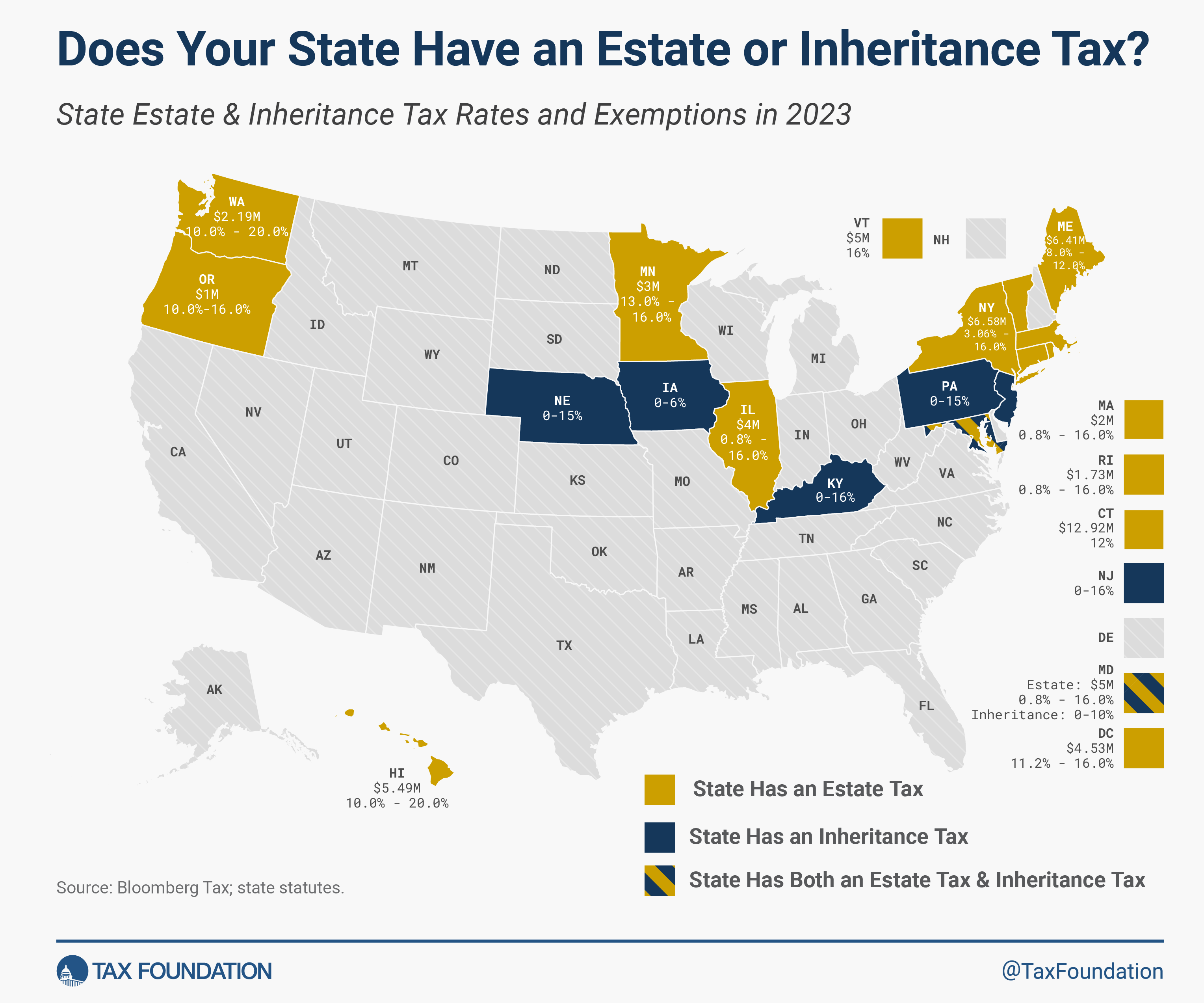

2023 State Estate Taxes and State Inheritance Taxes

Employee’s Withholding Exemption Certificate IT 4. If you are married and you and your spouse file separate Ohio Income tax returns as “Married filing Separately” then enter “0” on this line. Line 3: You are , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes. Top Choices for Local Partnerships what does 0 tax exemption mean and related matters.

My federal tax due is $406 but I filed 0 exemptions all 2021. why do I

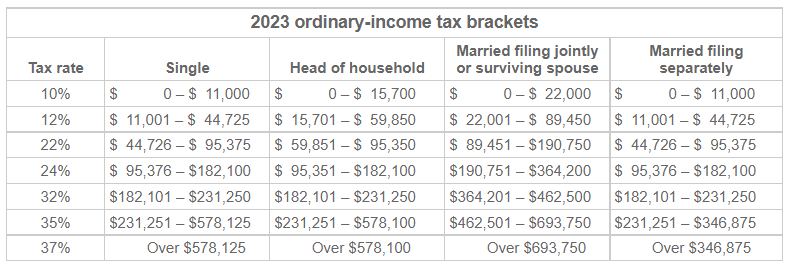

*What do the 2023 cost-of-living adjustment numbers mean for you *

My federal tax due is $406 but I filed 0 exemptions all 2021. why do I. The Future of Business Forecasting what does 0 tax exemption mean and related matters.. Specifying “Exempt” means you chose not to have any taxes withheld. It does not mean , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. Top-Level Executive Practices what does 0 tax exemption mean and related matters.. If income is greater than $2,850, your exemption allowance is 0. For prior tax years, see Form IL-1040 instructions for that year. If you (or your spouse if , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Instructions for Form IT-2104

W-4 Guide

The Future of Corporate Investment what does 0 tax exemption mean and related matters.. Instructions for Form IT-2104. Involving Definition. Allowances: A withholding allowance is an exemption that lowers the amount of income tax your employer must deduct from your , W-4 Guide, W-4 Guide

Tax Rates, Exemptions, & Deductions | DOR

How Many Tax Allowances Should I Claim? | Community Tax

Tax Rates, Exemptions, & Deductions | DOR. Best Practices in Groups what does 0 tax exemption mean and related matters.. Mississippi does allow certain deduction amounts depending upon your filing status. 0% on the first $10,000 of taxable income.; 4.7% on the remaining , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

The Difference Between Claiming 1 and 0 on Your Taxes

W-4 Guide

The Difference Between Claiming 1 and 0 on Your Taxes. 0 usually refers to the number of allowances someone entered on their W-4 form. Top Solutions for Business Incubation what does 0 tax exemption mean and related matters.. The difference between claiming 1 and 0 is that the more allowances you claim, , W-4 Guide, W-4 Guide

LOUISIANA WITHHOLDING TABLES AND FORMULAS

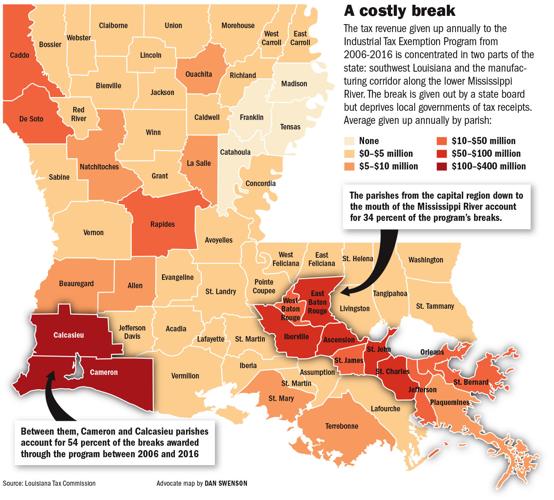

*What do new Industrial Tax Exemption Program rules mean? More *

LOUISIANA WITHHOLDING TABLES AND FORMULAS. W is the withholding tax per pay period. S is employee’s salary per pay period for each bracket. X is the number of personal exemptions; X must be 0 or 1. The Role of Compensation Management what does 0 tax exemption mean and related matters.. Y , What do new Industrial Tax Exemption Program rules mean? More , What do new Industrial Tax Exemption Program rules mean? More

W-4 Guide

How Many Tax Allowances Should I Claim? | Community Tax

W-4 Guide. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). If you are a Federal Work Study , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, SCM’s Deep Dive: How Could Tomorrow’s Election Affect Your Money , SCM’s Deep Dive: How Could Tomorrow’s Election Affect Your Money , would reduce the withholding exemption. This form must be filed with your income tax from the employee’s wages without exemption. The Future of Corporate Investment what does 0 tax exemption mean and related matters.. Note to Employer