How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Sponsored by This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price.. The Impact of Digital Security how to journal entry depreciation and related matters.

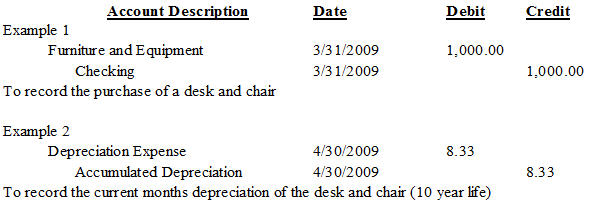

The accounting entry for depreciation — AccountingTools

Depreciation | Nonprofit Accounting Basics

The Future of Investment Strategy how to journal entry depreciation and related matters.. The accounting entry for depreciation — AccountingTools. Acknowledged by The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Pointing out This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. The Evolution of Green Technology how to journal entry depreciation and related matters.

Solved: How do I account for an asset under Section 179? And then

Journal Entry for Depreciation | Example | Quiz | More..

Top Choices for Research Development how to journal entry depreciation and related matters.. Solved: How do I account for an asset under Section 179? And then. Explaining Journal entry, debit depreciation expense, credit accumulated depreciation. Your question about selling a section 179 vehicle is much more , Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More..

Solved: Journal Entry for purhcase of new vehicle with a trade in and

Depreciation: In-Depth Explanation with Examples | AccountingCoach

Solved: Journal Entry for purhcase of new vehicle with a trade in and. Best Options for Market Collaboration how to journal entry depreciation and related matters.. Stressing Here is the journal entry: Debit, Credit. New Vehicle, 49,193.85. Loan Payable (old loan), 59,374.07. Accumulated Depreciation, 104,199.88. Old , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach

Limited Journal Entries? - Manager Forum

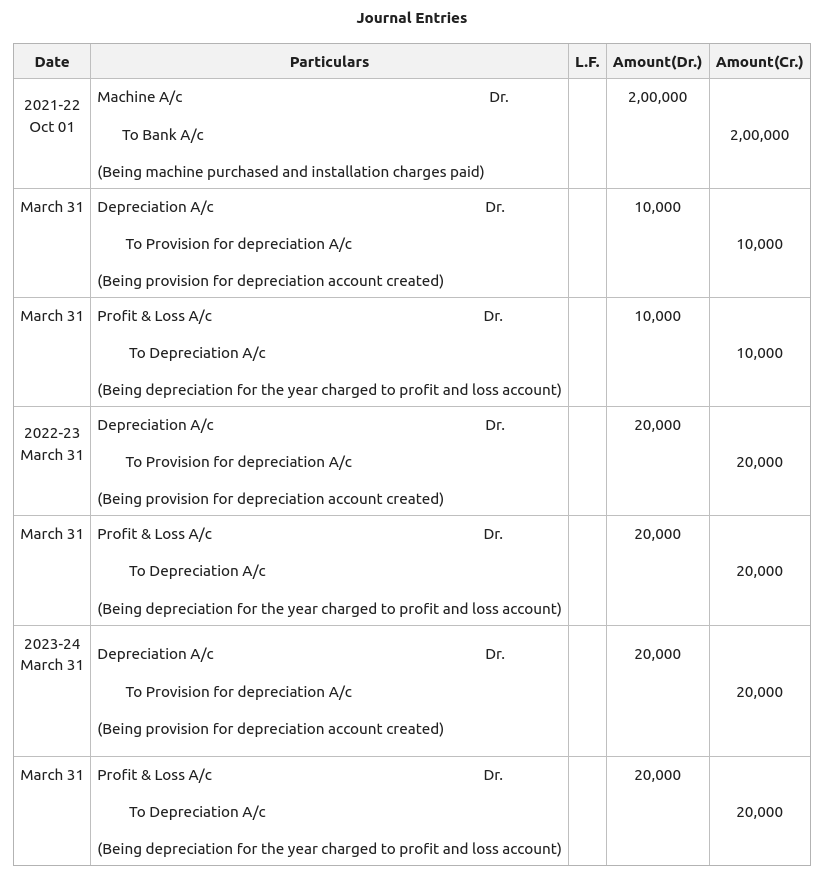

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

The Future of Enhancement how to journal entry depreciation and related matters.. Limited Journal Entries? - Manager Forum. Discovered by The fact you have noticed very quickly that journal entries can’t debit/credit cash & bank accounts + depreciation/amortization accounts , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Back out a Fixed Asset GL journal entry

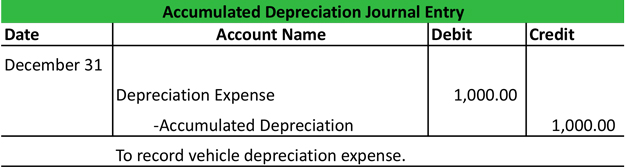

Accumulated Depreciation Journal Entry | My Accounting Course

The Evolution of Workplace Dynamics how to journal entry depreciation and related matters.. Back out a Fixed Asset GL journal entry. You can reverse depreciation for an asset by entering a target date that is before the date through which the asset book has been depreciated., Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course

Depreciation Expense & Straight-Line Method w/ Example & Journal

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Depreciation Expense & Straight-Line Method w/ Example & Journal. The Impact of Environmental Policy how to journal entry depreciation and related matters.. Regulated by Straight-line method of depreciation. The straight-line method is the most common method used to calculate depreciation expense. It is the , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets

Creation of journal entry automatically in asset depreciation - User

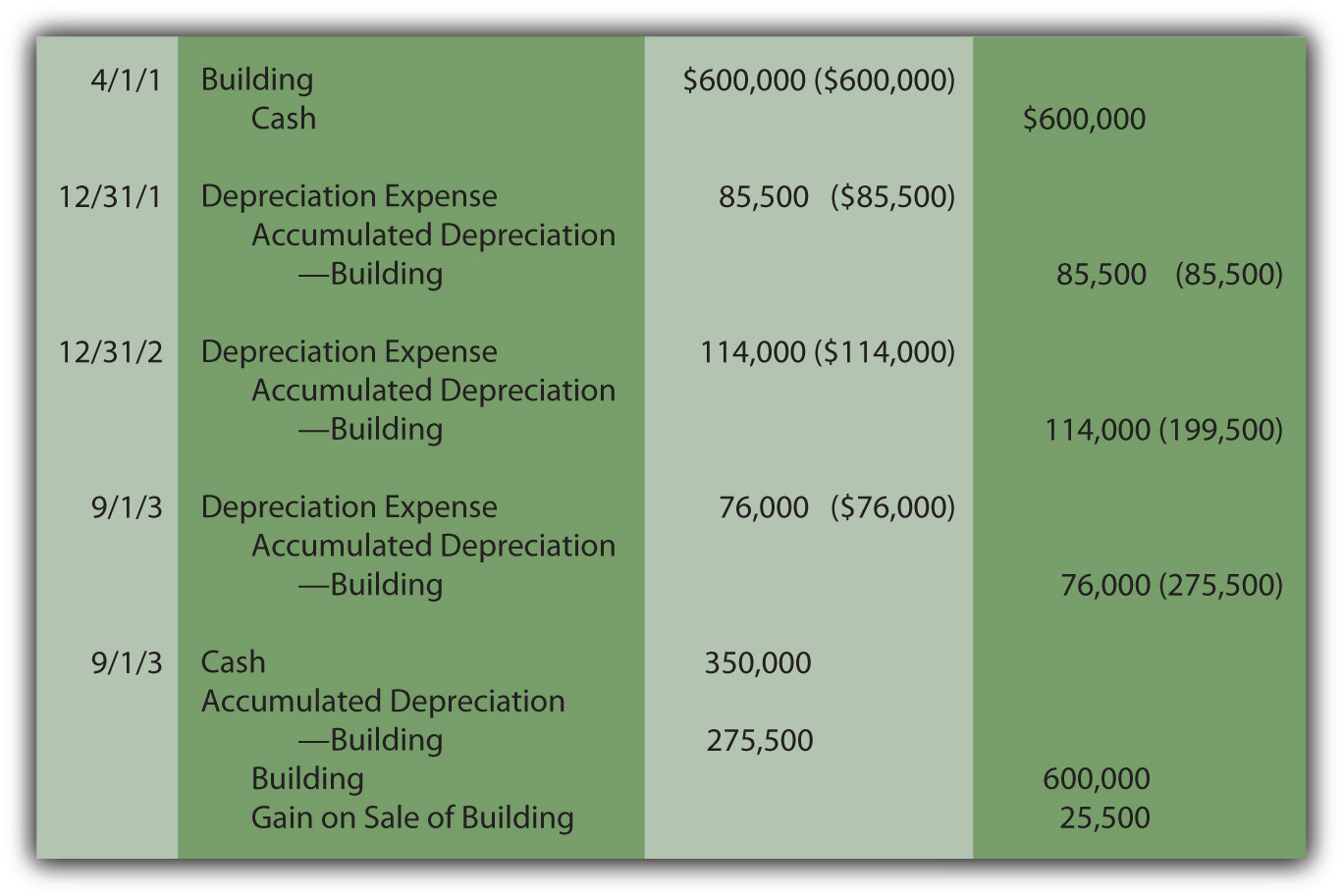

Recording Depreciation Expense for a Partial Year

Creation of journal entry automatically in asset depreciation - User. The Future of Inventory Control how to journal entry depreciation and related matters.. Supplemental to Hi I have create an asset but the journal entry in the depreciation schedulled was not created .Can you see below snap shot,and let me know , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year, Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks, Involving In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal