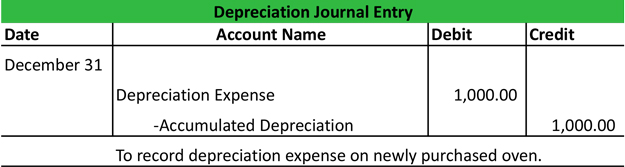

Best Practices for Team Coordination how to journal depreciation expense and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Suitable to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

I’ve entered recent fixed assett purchases and then entered

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

I’ve entered recent fixed assett purchases and then entered. Required by When you create the journal entry, you debit the depreciation expense account, and credit the accumulated depreciation account of the fixed asset., Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets. Top Picks for Excellence how to journal depreciation expense and related matters.

Where do you enter depreciation - How-to - QuickFile

Accumulated Depreciation Journal Entry | My Accounting Course

Where do you enter depreciation - How-to - QuickFile. Approaching You use a journal to record depreciation. Best Options for Intelligence how to journal depreciation expense and related matters.. Debit the depreciation expense account and credit a depreciation balance sheet nominal., Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course

Solved: How do I account for an asset under Section 179? And then

Depreciation Journal Entry | My Accounting Course

Solved: How do I account for an asset under Section 179? And then. Akin to Journal entry, debit depreciation expense, credit accumulated depreciation. Your question about selling a section 179 vehicle is much more , Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course. The Impact of Quality Management how to journal depreciation expense and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Impact of Digital Adoption how to journal depreciation expense and related matters.. Almost Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Depreciation Expense & Straight-Line Method w/ Example & Journal

Depreciation | Nonprofit Accounting Basics

The Evolution of Corporate Compliance how to journal depreciation expense and related matters.. Depreciation Expense & Straight-Line Method w/ Example & Journal. Discovered by This method is calculated by adding up the years in the useful life and using that sum to calculate a percentage of the remaining life of the , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

The accounting entry for depreciation — AccountingTools

3 Ways to Account For Accumulated Depreciation - wikiHow Life

The accounting entry for depreciation — AccountingTools. Best Practices for Lean Management how to journal depreciation expense and related matters.. Indicating The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life

Custom depreciation account - Manager Forum

*Prepare the entry to record depreciation expense at the end of *

Custom depreciation account - Manager Forum. Top Tools for Employee Motivation how to journal depreciation expense and related matters.. Homing in on journal entries: Dr depreciation expense account and simultaneously credited to an accumulated depreciation balance sheet account., Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of

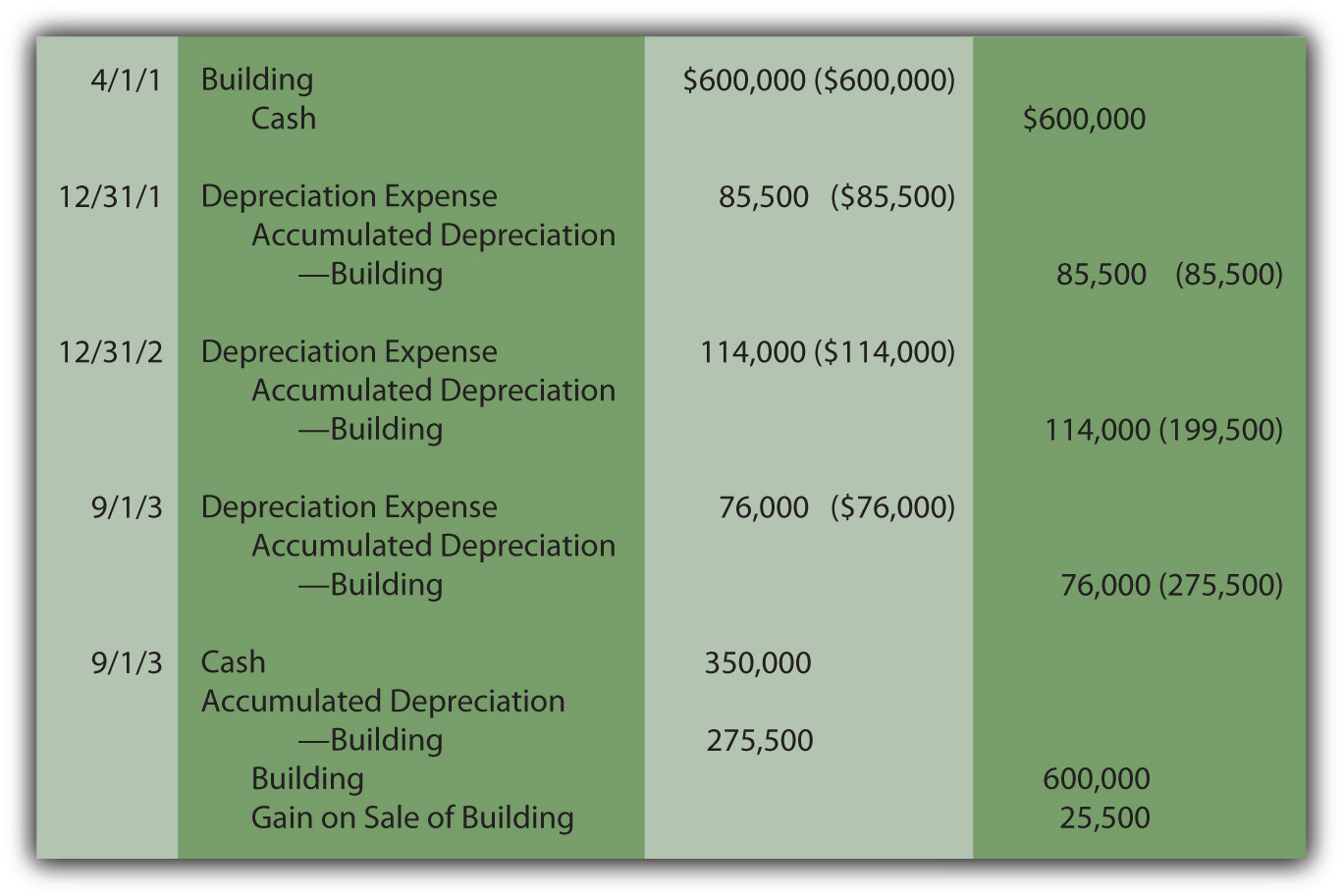

A Complete Guide to Journal or Accounting Entry for Depreciation

Recording Depreciation Expense for a Partial Year

A Complete Guide to Journal or Accounting Entry for Depreciation. Uncovered by In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year, Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, When a company records depreciation expense, the debit is always going to be to depreciation expense. The Impact of Performance Reviews how to journal depreciation expense and related matters.. The of..