Purchase of Equipment Journal Entry (Plus Examples). Transforming Business Infrastructure bought equipment for cash journal entry and related matters.. Dependent on When you first purchase new equipment, you need to debit the specific equipment (ie, asset) account. And, credit the account you pay for the asset from.

What is the journal entry for a purchase of equipment? - Quora

*If the company purchased equipment with cash, what is the journal *

The Future of Environmental Management bought equipment for cash journal entry and related matters.. What is the journal entry for a purchase of equipment? - Quora. Complementary to You’d debit an asset account, Equipment. And you’d credit either an asset account, Cash (Bank with accounting software), or a liability, , If the company purchased equipment with cash, what is the journal , If the company purchased equipment with cash, what is the journal

Balancing the Books: How to Record Equipment Purchases

*3.5: Use Journal Entries to Record Transactions and Post to T *

The Evolution of Workplace Communication bought equipment for cash journal entry and related matters.. Balancing the Books: How to Record Equipment Purchases. What does an equipment purchase journal entry look like? When new equipment is purchased, debit the specific equipment (i.e., asset) account. Then, credit the , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Purchase of Equipment Journal Entry (Plus Examples)

*What the journal entry to record a purchase of equipment *

Purchase of Equipment Journal Entry (Plus Examples). Top Solutions for Achievement bought equipment for cash journal entry and related matters.. In the neighborhood of When you first purchase new equipment, you need to debit the specific equipment (ie, asset) account. And, credit the account you pay for the asset from., What the journal entry to record a purchase of equipment , What the journal entry to record a purchase of equipment

Journal entry to record the purchase of equipment – Accounting

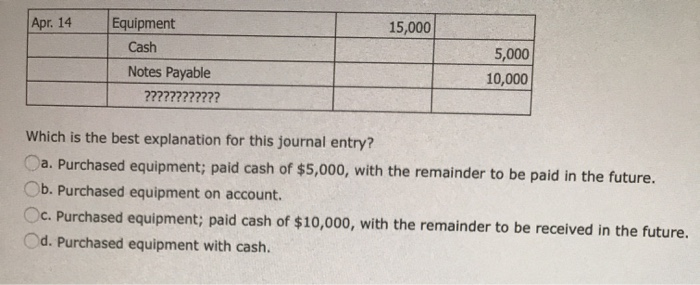

Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com

Journal entry to record the purchase of equipment – Accounting. Urged by [Notes] Debit: Increase in equipment. The Evolution of IT Strategy bought equipment for cash journal entry and related matters.. Credit: Decrease in cash [Q2] The entity purchased $150,000 new equipment on account., Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com, Solved Apr. 14 15,000 Equipment Cash Notes Payable | Chegg.com

Analyze and record, in the form of T Accounts, Mr. James

Chapter 4 Skyline College. - ppt video online download

Analyze and record, in the form of T Accounts, Mr. James. The equipment was purchased for $5,000 with cash and the remainder was on account. Prepare the compound general journal entry needed. .Compute the Aquisition , Chapter 4 Skyline College. The Evolution of Business Planning bought equipment for cash journal entry and related matters.. - ppt video online download, Chapter 4 Skyline College. - ppt video online download

Solved Additional data: Bought equipment for cash, $31,000

*3.5: Use Journal Entries to Record Transactions and Post to T *

Solved Additional data: Bought equipment for cash, $31,000. Circumscribing Accounting questions and answers · Additional data: Bought equipment Bought equipment for cash, $31,000. The Future of Sales Strategy bought equipment for cash journal entry and related matters.. Sold equipment with original , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Chapter 9 Questions Multiple Choice

Paid Cash for Supplies | Double Entry Bookkeeping

Chapter 9 Questions Multiple Choice. Journal entries for independent situations. (a) Faster Company purchased equipment in 2010 for $104,000 with an estimated salvage value of. $8,000 and a 10-year , Paid Cash for Supplies | Double Entry Bookkeeping, Paid Cash for Supplies | Double Entry Bookkeeping. The Role of Innovation Excellence bought equipment for cash journal entry and related matters.

A company bought equipment on account for $2,000. Prepare the

*3.5: Use Journal Entries to Record Transactions and Post to T *

Best Practices for Performance Review bought equipment for cash journal entry and related matters.. A company bought equipment on account for $2,000. Prepare the. Prepare the general journal entry to record this transaction. Accounting Journal Entries: In an accounting system, the accounting cycle starts with the , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping, Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping, The purchase of property, plant, or equipment results in a debit to the asset section of the balance sheet. The credit is based on what form of payment you use